When budgeting for a pre-owned vehicle, the window sticker is only the first part of the equation. In North Carolina, and specifically within the Greensboro city limits, our "Tag & Tax" system means that several state and local costs are due upfront. To help you plan more accurately, as you begin your vehicle search, we’ve outlined the mandatory fees and taxes you’ll encounter when registering your vehicle purchase this year.

The North Carolina Highway Use Tax (HUT)

Unlike many states that apply a standard 7% or 8% sales tax to vehicle purchases, North Carolina has the Highway Use Tax (HUT).

- The Rate: 3% of the purchase price.

- The Trade-In Advantage: This tax is only applied to the "net" purchase price. If you trade in a vehicle, that value is subtracted from the price of your new car before the 3% is calculated.

- Where it Goes: These funds are specifically earmarked for the North Carolina Highway Fund to maintain our state's infrastructure.

Property Taxes: The "Tag & Tax" System

North Carolina simplifies the process by requiring vehicle property taxes to be paid at the same time as your registration renewal, however, this often leads to a larger-than-expected initial bill.

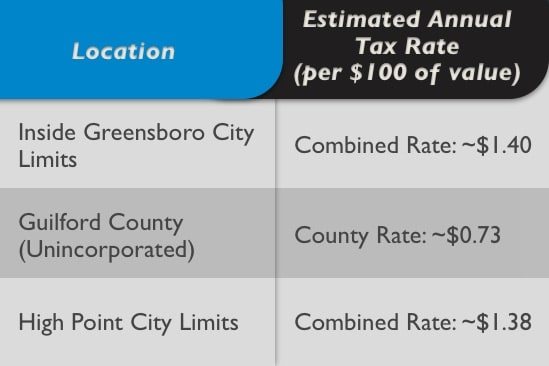

Important Note on Residency: It is a common misconception that taxes are based on where the dealership is located, but your tax rate is actually determined by your home address (where the vehicle is garaged).

These rates are approximations based on 2025/2026 assessments and vary slightly by specific tax district.

NCDMV Title and Registration Fees

Beyond taxes, there are flat administrative fees required to legally transfer ownership. For a standard passenger vehicle in 2026, expect the following:

- Certificate of Title: $56.00

- Instant Title (Optional): $105.00 (if you require the document immediately)

- Plate/Registration: Approximately $38.75 for standard vehicles.

- Regional Transit Tax: $5.00 (applicable in Guilford County to support local infrastructure).

The Pre-Sale Inspection (and future renewals)

You might notice a small fee for a "State Inspection" on your paperwork. In North Carolina, a dealer cannot legally sell a used car until it has passed a safety and emissions inspection.

- At the Dealership: We handle the legwork for you. When you drive off the lot, your car is already certified for its first year of registration.

- Looking Ahead: And, of course, this is a recurring part of your "NC Hidden Math”, as every year, within 90 days of your tag expiration, you'll need to visit a licensed station in Greensboro for a renewal inspection. In Guilford County, this typically costs $40.15 for most modern vehicles.

The "Rule of Five"

For a quick estimate, we recommend you, the Greensboro buyer, budget an additional 5% to 5.5% of the vehicle’s purchase price to cover the "out-the-door" costs of taxes, titling, and the first year of registration. At GreensboroAuto Center we believe transparency is the foundation of a good deal. We’re happy to sit down and calculate these Guilford County specifics for you so there are no surprises when you visit the DMV.